CAPATA Financial’s take on today’s FOMC press conference and announcement

From the FOMC press conference

“Recent indicators suggest that economic activity has continued to expand at a solid pace. GDP rose at an annual rate of 2.8 percent in the third quarter, about the same pace as in the second quarter.”: The Federal Reserve, along with market participants, has been predicting “below-average growth” for quite some time, but this has not been the case. The rate of growth of the economy, combined with the uncertainty of future tariffs, made this a closer call than expected. Notably, the SEP (Summary of Economic Projections) indicated that four members did not support a rate cut at this meeting, with only one dissenting vote. This outcome was clearly influenced by the rotation of votes among reserve bank presidents and highlights the significant apprehension within the full committee.

“Overall, a broad set of indicators suggests that conditions in the labor market are now less tight than in 2019”: Powell referenced multiple labor market data points to provide evidence of the ongoing cooldown. He then de-emphasized inflation and its future trajectory, stating that the committee sees that story as “broadly on track.” He emphasized the labor market as the area most likely to deviate further from their mandate compared to inflation. Recall that Powell cut interest rates by 75 basis points in 2019, brining them to 1.50%.

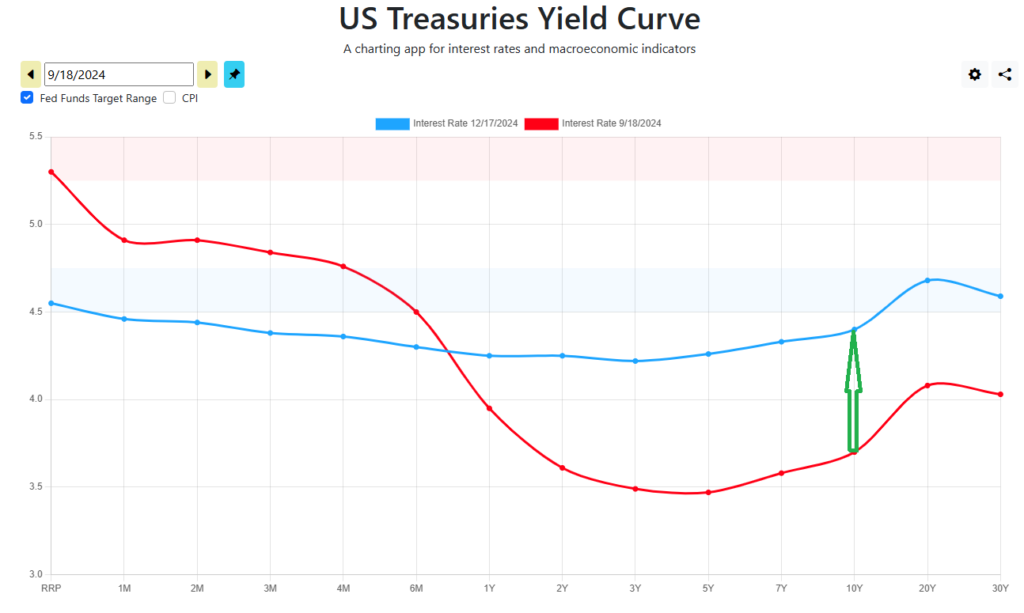

“we have reduced our policy rate now by 100bps. We are significantly closer to neutral. At 4.30%… we believe policy is still meaningfully restrictive.” : Powell emphasized that the committee can proceed cautiously moving forward, as they believe they are closer to a neutral stance. Although short-term rates have now been reduced by 100 basis points, long-term interest rates have risen significantly since the September meeting, tightening financial conditions. See graph below:

Red 09/18/24: 10yr at ~3.68%

Blue 12/17/24: 10yr at ~4.40%

In summary, both the SEP and the press conference were more hawkish than many market participants had anticipated. The committee indicated they are now pricing in two rate cuts for next year, compared to four in the September SEP. The FOMC also left the balance sheet runoff ( Quantitative Tightening, or QT) unchanged. Both the forward guidance and the continuation of the balance sheet runoff serve as hedges against inflation and, more importantly, against long-term inflation expectations.

Overall, short-term rate are expected to remain elevated for an extended period, with the committee now taking a more cautious approach toward achieving a neutral stance. The key question for the economy is how much influence short-term rates have on long-term rates within an ample reserves monetary policy regime. If short-term rates continue to decline while credit conditions, as reflected by the 10-year Treasury note, tighten further, at what point does the federal funds rate lose its status as the primary transmission tool of monetary policy? At that juncture, does the balance sheet-specifically its maturity composition and size-emerge as the dominant policy instrument?

| mike@capatafinancial.com |

| (949)304-5300 |

| CAPATA Financial, LLC Partner |

| http://www.capatafinancial.com |

Source: Federal Open Market Committee (FOMC), Press Conference, December 18th, 2024

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

CAPATA Financial LLC offers wealth management services through various unaffiliated companies including advisory services offered by Diversify Advisory Services (“Diversify”) an SEC registered investment adviser. CAPATA Financial LLC offers additional investment services and securities through DFPG Investments, LLC., a broker/dealer, member FINRA / SIPC, and an affiliate of Diversify.