Be Proactive About an IRS Audit

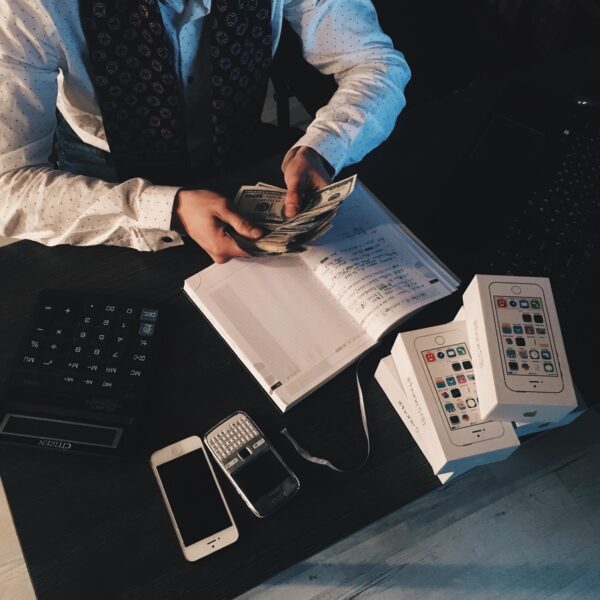

BE PROACTIVE ABOUT AN IRS AUDIT One of the many goals business owners have is to avoid an IRS audit at all costs. However, audits happen less frequently than you may think. Audit rates are at a historical low, with only 0.6% of individuals being audited for the 2018 fiscal year. Although this is good news, there is no guarantee that your business won’t be picked for an audit. Businesses, … Read more