CAPATA Financial’s take on today’s FOMC press conference and announcement

Notable comments from Chairman Powell during today’s FOMC press conference and announcement.

- “The Committee has gained greater confidence that inflation is moving sustainably towards 2 percent, and judges that the risks to achieving its unemployment and inflation goals are roughly in balance.” : The Fed continues to shift its focus from fighting historically high inflation-while unemployment remains historically low-toward its maximum employment mandate. With inflation moving closer to their target, they can now direct policy towards impacting the labor market.

From the FOMC press conference:

- “Labor market has cooled from its formerly overheated state.”: Powell repeatedly mentioned the labor market, noting that the ratio of job openings to job seekers has consistently declined throughout this tightening cycle. For over a year, he has emphasized that “this time may be different,” suggesting the labor market could cool without a significant rise in unemployment, as supply and demand factors come into better balance. This observation now appears prescient as the ratio moves closer to 1:1.

- “Upside risks to inflation have diminished… downside risks to employment have increased.”: Powell reiterated that this shift represents a “recalibration of policy” toward a more ‘normal’ stance, aiming to support both the economy and labor market. When pressed on the dual mandate, he highlighted the labor market and expressed confidence that historically low (albeit rising) unemployment rate is unlikely to become a future driver of inflation.

- “We don’t think we are behind; we think this is timely, but I think you can take this as a sign of our commitment not to get behind.”: This was Powell’s response to a question about whether the Fed’s 50-basis-point move signaled the need to catch up, given that the first rate move is typically 25 basis points. Powell has previously stated that the Fed was behind the curve in tightening policy in 2022 but emphasized that today’s move is to prevent falling behind again. He also noted that if they had received the July jobs report before the last FOMC meeting, they might have acted then.

- “…Our job is to support the economy on behalf of the American people…”: This comment is significant because Powell was adamant in distinguishing Fed actions between protecting macroeconomic stability and adjusting monetary policy, particularly during the Silicon Valley Bank collapse. When asked about the influence of the President and election timing on rate cuts, Powell reaffirmed that the Fed’s focus remains on its dual mandate and that no political considerations have influenced decisions during his four Presidential election cycles on the Board.

- Balance sheet runoff (QT): Paradoxically, the committee has not paused its balance sheet runoff (QT)—a form of tightening—while simultaneously reducing the degree of policy restraint by lowering the Fed Funds rate. This surprised at least one reporter, who recalled Powell’s 2019 statement that it would be counterproductive to loosen policy with one tool while tightening with another.

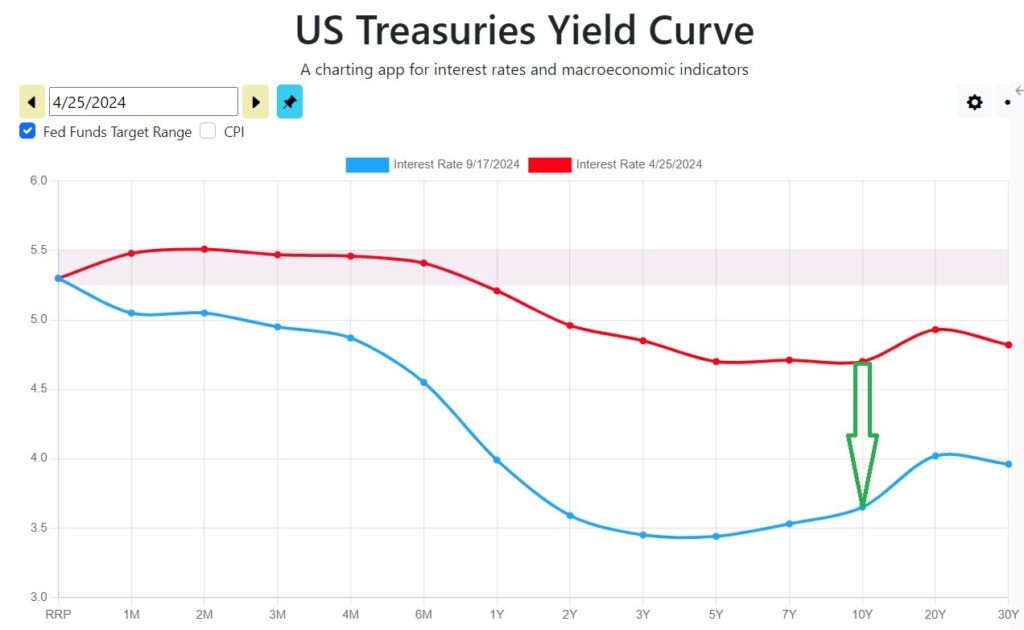

The Treasury yield curve below shows the movement from 04/25/24 to 09/17/24:

- Specifically highlighted by the green arrow is the shift in the 10-year Treasury yield from approximately 4.7% on April 25, 2024, to around 3.68% as of September 17, 2024: We’ve seen a significant move of over 100 basis points in the 10-year yield since the end of April. This downward movement in the 10-year has substantially loosened credit conditions without a corresponding reduction in the Fed Funds rate, a trend typically observed during periods of financial stress. The market has already priced in multiple rate cuts, which either compels the Fed to align with these expectations or signals that the market is ahead of itself and must adjust its long-term outlook.

In summary, Powell highlighted the Fed’s focus on its maximum employment mandate and broader macroeconomic stability over concerns of persistent inflation during the press conference. The key shift occurred when Powell discussed “recalibrating policy,” emphasizing the Fed’s role in supporting the economy. Historically, the Fed has been effective at curbing inflation through rate hikes, but less so in stimulating employment through lower interest rates, which is the primary tool of monetary policy via the Fed Funds rate.

With higher nominal and real interest rates throughout the yield curve—and what many economists estimate as a higher R* (R-Star)—the Fed now has significant policy space. This provides it with the ability to act without relying on non-traditional tools like quantitative easing (QE) or balance sheet operations. More importantly, as inflation approaches the 2% target, the market itself can now act as a feedback mechanism for the Fed’s decisions, as evidenced by the loosening of credit conditions driven by falling long-term yields. The key question remains: Was the recent rally in the 2-10 curve a signal of macroeconomic stress or an overreaction to forward guidance?

| mike@capatafinancial.com |

| (949)304-5300 |

| CAPATA Financial, LLC Partner |

| http://www.capatafinancial.com |

Source: Federal Open Market Committee (FOMC), Press Conference, September 18th, 2024

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

CAPATA Financial LLC offers wealth management services through various unaffiliated companies including advisory services offered by Diversify Advisory Services (“Diversify”) an SEC registered investment adviser. CAPATA Financial LLC offers additional investment services and securities through DFPG Investments, LLC., a broker/dealer, member FINRA / SIPC, and an affiliate of Diversify.